Taxes Taxes Everywhere and how our wallets did shrink… Even our Savings are Taxed, and in time it won’t even amount to a drink.

First of all, what is the real incentive for people to save when the value of the dollars they save depreciate so rapidly they might as well have bought a stock option. Of course, there is the interest that can be collected. However, interest rates are still so low versus the true rate of inflation (as I explained in past episodes of mo’ MONEY [Note 1]), that you’re savings will still lose value over time. And WAIT! Don’t forget that we’re also taxed on that interest! Top off the fact that with high inflation, it is harder to save because people are forced to pay higher consumer prices for the same products just to maintain their current standard of living. And for those who have the guts (and the skills) to warrant pushing for a raise, you’ll still be lucky if your salary just keeps up – forget about getting you ahead.

So, let’s see how many ways are same dollars are taxed:

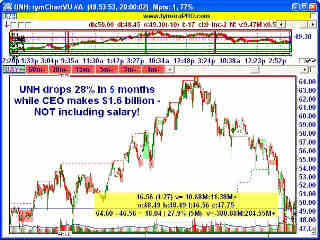

So, let’s start with Income Taxes. That’s on new money you earn, and also includes taxes on any dividends, interest and investment gains you make as well. Now, the rest we should get to keep, right? Hmmm… For starters, don’t forget that investment gains on public companies are actually taxed twice, at the company level, and again on your dividends and capital gains. If you take a capital loss, you’re limited to deducting only $3,000 per year of those losses versus any other actual income, so one more punch for you. [Note 2]

Ok, add state taxes, property taxes, and sales taxes.

If those taxes don’t get you, add in the cost of inflation to whatever you save.

You may get a little back from social security (if you’re lucky), but between the adjustments for underquoted inflation rates and the fact that those checks are still taxed as income, I’d be surprised if it would pay for a night in the hospital if you needed it.

And hey, if they still don’t get you, don’t worry… If you managed to save anything substantial through assets and other investments, they’ll get you with estate taxes!

If you really think about it, you realize you are little more than a slave to a system that will make it nearly impossible to ever consider a real retirement.

Inflation has been used for thousands of years to bleed wealth from the masses, so this is nothing new. In America, the Federal Reserve was established under the premise that such an entity was needed to protect us from monetary panics. It’s true purpose was to control the money supply, create inflation, and issue debt. [Note 2] And although the Fed has been unable to avoid any major financial panic, it’s policies are directly responsible for every panic and monetary problem that we face today. Which leads to the Fed’s even greater talent… Managing and containing public inflation fears through clever tricks and by instilling a false confidence.

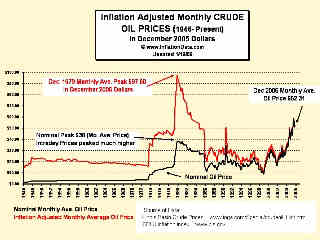

It is interesting to note that in general, consumer prices did not rise at all for the entire 19th century, and in fact remained relatively stable from 1800-1970 (the year the dollar was taken off the gold standard altogether). Add 35 years to the present, and we find that consumer prices have now soared over 600%. This price inflation is also factored into the GDP figures and gives us the false sense of security that our economy is actually growing.

If we want to get commodity prices under control, and offer more Americans a real chance at long-term prosperty, perhaps we should end the Fed’s reign and consider returning to a solid currency backed by solid obligations. What better legacy to leave our children than “a dollar saved today will be worth as much as a dollar earned when we retire”.

Note 1: Gold alone is not is in fact not the best indicator of inflation not only because of it’s ability to be manipulated, but also because of competition from other assets that act as an inflation hedge, which would not only include stocks, but especially real-estate with its added leveraged “punch” of as little as zero-down (with interest-only mortgage loans). The real problem is that even though inflation and the money supply may offer some level of “soft landing”, it still cannot protect people from the tremendous levels of leveraged debt they incur.

Note 2: Actually, to President Bush’s credit he has made some great strides in this regard by lowering taxes on capital gains and dividends and spurring increased investment. However, we still have a long way to go, especially in the area of corporate tax reform. In addition, taxes on capital gains and investment should be all but eliminated, and there should not be a minimum time period associated with people’s holdings (ie. one year to receive the reduced “long-term” tax rate). Such incentives cause people to invest capital where it can do the most good – including investing in themselves through the creation of small businesses. Evidence supports that the continual flow of money to new and greater potential investments without regard of associated tax consequences of moving away from stale and stagnant ones can only lead to greater prosperity and economic growth. And yes, that includes the creation of new jobs!

How does anyone win if investors don’t want to sell a position because it’s not quite yet a “long-term” gain. This is also relevant to long-term positions, albeit to a less degree due to a much lower tax-rate (now at 15%). For example, an investor who see some of his holdings overextended will likely opt not to sell for 3 reasons. 1) taxes will have to paid on the gain, 2) shares reaquired at lower prices will be at short-term rates again for another year, 3) taking any short-term losses (including positions rebought in the same stock) used to offset the original closed long-term gain will again reset the long-term counter, and cannot be rebought for 30 days (wash-sale rules). Result? Stagnating capital locked away in long-term investments mainly due to tax consequences.

Note 3: When the Federal Reserve was first established, its intended function was to provide an “elastic money supply” that grew as the economy expanded, and shrank as it contracted. What happened instead is that modern central bankers grow the money supply during economic expansions, and then grow it even faster during contractions (adding “stability” and liquidity by dumping loads of cheap money into the money supply). As a result the Fed has become nothing more than an engine of inflation, growing the money supply indefinitely, in direct contradiction to its original mission. Had the public been properly informed that the fed had the power to function in this manner during its inception, it is doubtful that the Federal Reserve would have ever been established.

2 Comments »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL

Not sure why bing sent me over here but I might as well say I am now overall entertained by the blog content you have sourced together. How long did it take to end up with that many WWW users to your page? I am fairly to this web thing.

As an addition to this, Congress should also allow U.S. oil companies to drill off the U.S. coast where there are huge known reserves of oil and natural gas. This would make great strides towards stablizing energy prices and providing a cushion against Middle-Eastern supply issues. It is amazing that even with a Republican Congress they have not made more progress in this regard.

http://english.aljazeera.net/NR/exeres/05957D0B-C171-41A9-9622-0C52E5A73E44.htm

http://www.nytimes.com/2006/05/09/washington/09drill.html?ex=1304827200&en=563832ca3aa05e17&ei=5088&partner=rssnyt&emc=rss