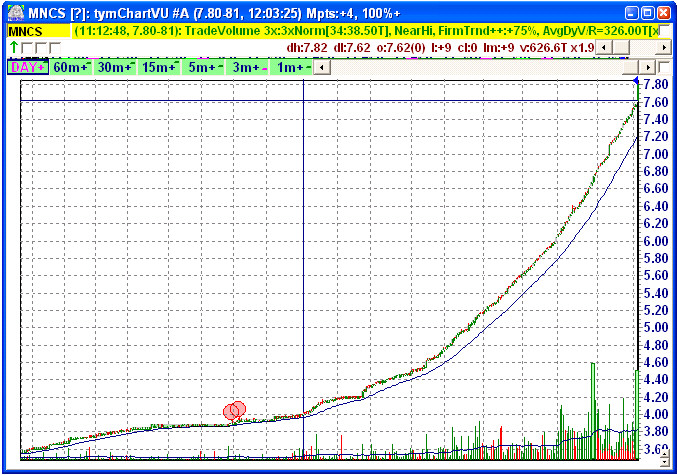

Be sure to check out the Notes/Transcript section for updates on MNCS… It doesn’t go down… until it finally does… then watch out! Remember Jesse Livermore’s old adage, when the markup’s over, it’s reeeealllly over.

After understanding a bit more of the markup cycle of stocks, what would you consider doing with MNCS? The price action is unbelievable and such perfectly steady moves are nearly unheard of. It would also seem that such an extended multi-year move would be very difficult to sustain if there were not something behind it to substantiate it. However, to date very little news or information is available on this bulletin board stock (which could in fact be a very good thing, as it keeps people on the sidelines kicking themselves each day they don’t buy it). The stock’s float is 33.1 million shares, with some former directors of the company holding nearly 40% of those shares according to the most recent 10-Q filing. With a current market cap of about $250 million, no income, and virtually no money in the bank, the company plans to enter the “Buy Here/Pay Here” auto industry. Previously, it had plans to engage in the acquisition and exploration of mining properties primarily in Canada. So it would seem as if there may be some sort of reverse merger going on here.

Of course, for all we know it could also be some giant perfectly orchistrated ponsi scheme. But by closely watching the tape and the behavior of the market makers moving the stock, we can extract clues not only to if the move will likely continue, but also to the possibility of when the move may begin to falter or approach some sort of grand finale (possibly with one final bang and blow-off move where the smart money can “feed the ducks while they’re quacking”). Until then, anyone want to take a shot at shorting it? Or is it better to just “go with the flow” so long as the tape confirms the price action, then possibly consider reversing once the tape and again, the price action, give us confirmation that the “mark-up” cycle is over?

Caveat emptor – I began accumulated this stock just a few months ago from much lower price levels that even now seem like a distant memory, and I may sell the moment I don’t like how the stock behaves. However, as the stock has continued to prove me “correct”, I have systematically increased my positions in the stock, albeit taking into account the worst-case scenario that for all we know, the party could end at any time. I do anticipate some clear danger signs to appear before that occurs. However, in the markets, the only thing traders can truly control is the size of their trading positions. As an update, just before completing this episode, MNCS jumped over 20 cents in one day (as opposed to its usual 2 to 3 cents) on over a million shares traded, which while great for my P&L, may also mean we’re getting ever closer to the end of the move. So far, the new higher price level still seems to be holding well.

| The concepts here are classic Jesse Livermore all the way. I quote from “Reminiscenses of a Stock Operator”, “Stocks are manipulated to the highest point possible and then sold to the public on the way down.” Initially, my biggest fear was that MNCS is an over the counter bulletin board stock, and as many know this space is filled with shananigans, which could materialize as a halt and then sharp drop in the stock. Additionally, order execution is tricky because the market makers can back away from a trade and are under no obligation to provide a fill. This is manageable if things are trading slowly, but in a fast market, forget about it. |

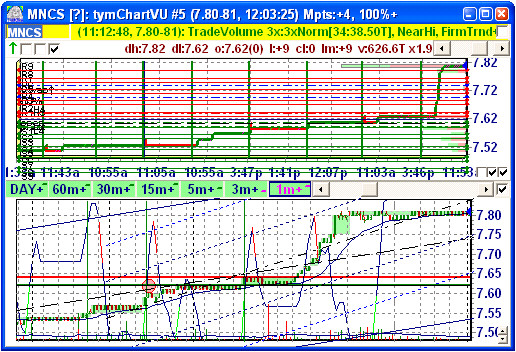

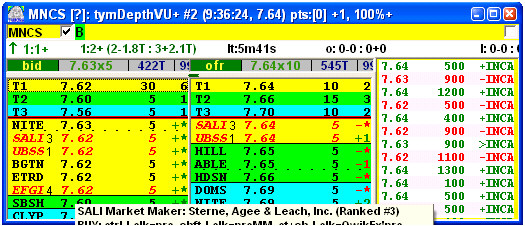

However, from my analysis of the tape (and with the help tymoraPRO – the trading platform I created), the verdict has remained up. I see the same key market makers working the stock exactly as they should be, creating a continually tight market to make the smart money buyers comfortable accumulating the stock. The market makers offer enough stock when necessary to check the price rise and enable other smart traders to participate, then buy back and resupport the stock on any hint of weakness. And at those key points in the underlying cycle, which tymoraPRO also clearly shows me, I’ve looked to increase my positions.

This is a key to trading that most people simply don’t understand. You don’t want to build positions as they go against you. That’s what 32 year old Brian Hunter did over at the Amaranth Hedge Fund, leading to a wipeout of nearly $6 billion dollars of capital so fast it would make your head spin. Consider two key points here. 1) If all of his leveraged buying in his Natural Gas calendar spread was unable to move the price toward his goal and attract additional interest, who would be left to take the position off his hands, and 2) Imagine if he had accepted early on that his position was not having the desired effect on the market and possibly reversed his position and increased it as it proved him correct. His story may have had a much different ending. Of course, there’s still no rational explanation for why he was allowed to carry such huge positions – especially in such relatively illiquid assets – versus the diversified nature of the fund. Additionally, the fund’s management apparantly has as much to learn about humility and risk management as does Mr. Hunter, who seemingly just took a massive gamble on someone else’s dime hoping to get an even greater bonus second year around. He supposedly earned upwards of $100 million in bonuses last year, which was also likely based on another, albeit more lucky, longshot bet he placed. In the grand scheme of the game maybe what he did wasn’t so foolish. Although investors in Amaranth may have lost out, earning $200 million this year or getting fired and still having plenty to retire happily ever after may not be such a bad deal (“heads I win, tails you lose”).

I recently compiled a great deal of my trading knowledge into a new DVD, “Be Your Own Hedge Fund: Learn How to Successfully Trade the Stock Market“, which not only teaches you how to find and analyze such trading opportunities as MNCS, but also how to properly build positions in them as well. If only the management team at Amaranth had watched and studied the course. For a much smaller tuition fee, it would have reinforced the right way to trade and analyze the markets and likely saved them, oh, say, $6 BILLION dollars. And who knows, they may have even made a few extra bucks building a position in sync with the market instead of fighting it every step of the way.

Recent updates: Manchester, Inc. Acquires Nice Cars, Inc. & Nice Cars Capital Acceptance Corp. Also fueling the move is that MNCS has been filing reports with the SEC, which further increases the appearence of credibility, with claims that they may also be soon filing for a Nasdaq listing.

Of course, when a stock finally goes exponential, that also means we’re likely close to the end and you’ll want to sell into that move. Hopefully the end won’t materialize as a hard gap down. Unfortunately for MNCS, that’s exactly what happened on October 12th after the release of an 8-K filing on October 11th. People may look to bottom fish in this stock, but remember Jesse Livermore’s old adage, when the markup’s over, it’s reeeealllly over…

Crash Day 1: Notice how any small attempt at a rally was quickly met with intense new selling – and the rallies became weaker and weaker… Market-Maker SALI led the selling in the 6.10 to 6.15 price range and wouldn’t let the stock budge. He also sold huge amounts of stock at the offer each day of the final explosive run-up of the stock. Crash Day 2 took prices as low as $2.70/share. There may be a rally from here to squeeze out all the shorts and frustrate those who dumped too late – especially with positions on margin. However, from then on MNCS will likely slowly fade into obscurity.

4 Comments »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL

MaxBoost 2.1.0.7 The name of the hard disk manufacturers Maxtor said the company’s new software driver “MaxBoost” to the company is a manufacturer of hard disk performance increase 60%software .MaxBoost is a hard drive performance of the software driver, available at Microsoft Windows2000 and XP operating systems running this software is designed to enable the production of Maxtor parallel ATA or serial ATA interface hard drive performance is more perfect .MaxBoost software to Maxtor hard disk read-write data intelligently will host system RAM (random access memory) as a cache to store data, resulting in a system and the application is in any State can improve system effective storage data the software minimum requirements: 256 MB and 700MHz processors.

big league post you lock up

ciao!, thanks for the information, this post was really useful ! avafx forex broker

mncs, the website for the nicecars.org is just that. i talked with a

recep and she said that the biz pumps cars btween yrs 2000 to 2004. they

are adding 2 more dealerships in gorgia or tenn or both. the vibe was

great along with being friendly, the sales people like thier jobs. this

thing is going to 25 with at least 1 split (my opinion). i to have my

finger on the trigger and i have locked in my position on a few thousand

shares, but it appears to be a greed factor and the fear of missing out on

this monster. have fun and nice web site