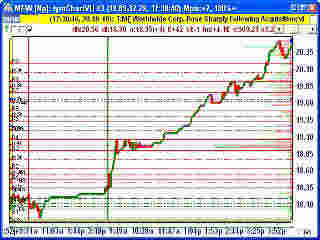

The “smallest” loss with NYSE:JNJ giving up about 2.01% for the day, with NYSE:DIS down the most, giving up 6.29% for the day. NYSE:VZ held a close second at -5.57%.

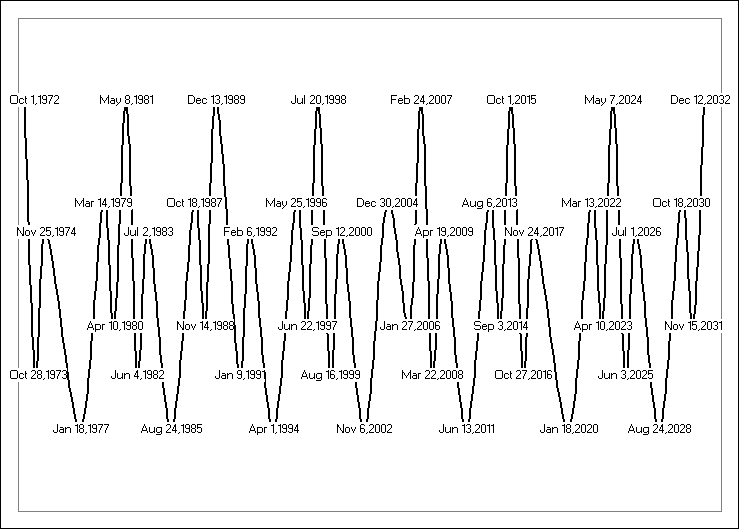

Definitely check out the notes/transcript section for this video, as there is quite a bit of very interesting additional info presented… a man named Martin Armstrong years ago predicted February 27th, 2007 to be a turning point in the business cycle.

Now for the big clincher. NYSE’s new Hybrid system… Traders are still getting acclimated with NYSE’s new Hybrid System, where the specialist essentially steps back and lets things be most of the time. So, now we have the NYSE stocks trading very much like Nasdaq stocks, flying through prices in a blink of an eye. Throughout the day, with NYSE’s Hybrid system now more than ever, it’s not unusual to see vacuums of price action based on a bunch of orders entering a stock. However, routing stocks to the NYSE (which is still what many firms do for NYSE stocks) still does not necessarily receive quick fills, and SuperDOT (how traders access the NYSE quote) does not always quickly acknowledge cancel requests. In the past, traders would use NYSE market orders, or they may place a wider price limit on their order knowing the specialist would step in at some point and possibly offer price improvement on the order. That no longer exists, and the end result? Now there’s no telling where you may get a fill, and on a limit order (especially in a fast market), it will likely be the worst price you can get given your limit price – just like an ECN with no liquidity. So traders will cancel and replace orders all the way down, trying to catch a price on the bid, and with each miss attempt to catch the next price, which within seconds may already be down another 25 to 50 cents. Combine this for 30 DOW stocks, and in one minute, you’re suddenly down 250 before the specialist may even consider possibly stepping in at what would now be bargain-basement firesale prices. Is there a solution? As a trader, always consider your worst case scenario, don’t exit in the midst of a panic, properly size your positions accordingly, and possibly consider stepping into a position (expecting a recovery) once the panic subsides and more normalized trading resumes. For longer-term investors looking to add a few positions, it’s after times like these that you want to consider buying for the long-term, not after the market has gone higher and higher month after month. See if you can pick up some high quality stocks at great bargain prices of your choosing once the markets settle down and restabilize themselves. (Remember not to buy all at once…)

Could this move be the beginning of a larger market sell-off? Possibly. I’ve included a link in the transcript section on some interesting cycle research on that issue. Shorter term, such mass forced liquidation does tend to lead to a decent bounce back. In fact, the DOW already recovered to around -300 for the day before moving lower again.

Once trading settles down and people begin to lose interest, we’ll be able to see if the market continues to slowly break down further or manages to find some new support.

Notice how the high for the current cycle is shown as February 24th, 2007 (likely a typo, as in Martin Armstrong’s Economic Confidence report available below, he actually lists Feb 27th, 2007 – today’s exact date – as the key turning-point date)!

No Comments »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL