Alexander: Thanks so much for joining us today Vienna. So, Please tell us more about how banks are making loads of money off their clients.

Vienna: Hey Alexander, so great to see you again – no problem. I love to share with my loyal fans!

Vienna: Now, you know that current short-term interest rates are over 5%. That means that for every $10,000 you have just sitting in a bank account, at the end of the year you should have at least an extra $500 for doing nothing but waiting! In fact, if you have over $100,000 sitting in a bank account like I usually do, except you DIDN’T take anything out, you should have OVER $5,000 MORE at the end of the year if you consider that the APR (or Annual Percentage Rate, sometimes also APY for Annual Percentage Yield) will be even higher due to the effects of compound interest. Of course, the taxman will come in and take his chunk at the end of the year and knock that down, but here’s the real clincher. Most of you may never see more than a fraction of that on your money. Why? Because THAT’s how most banks make their “monthly fees” off of you!

Alexander: That’s fascinating Vienna. Please, tell us more!

Vienna: Sure Alexander, no problem! Imagine that you have even just $10,000 sitting in a bank account that charges you no monthly fees. But you think that’s okay, they still pay you a little bit of interest! Well, if you look closer, and IF they pay you any interest at all, it may be in the area of 0.10%!!! And for savings, I’ve seen as low at 0.25% to perhaps 2% from accounts that require $5,000 minimums to waive the fees! So the real question is, how much is a “free” account really costing you if you leave more than $1,000 or so in it at a time?

Alexander: Wow, so for a $10,000 account that SHOULD be earning 5% a year, your account – considering that the APR should be even higher – is likely costing you at least $40 to $50 PER MONTH!!! That’s nuts!

Vienna: Exactly, Alexander! Hey I may like to spend but I also know how to earn what I’m due! I mean, how would you like to have THAT kind of extra cash in your pocket! Now multiply that for every additional $10K you have sitting around, and you’re talking some real cash!

Alexander: Wow Vienna, that’s awesome! Now banks do offer CDs – Certificates of Deposits – and I don’t mean Compact Discs! Can’t people just buy a CD as well?

Vienna: Yes, they can Alexander. But that’s also another gimick for the most part! The SHORT-TERM rates are currently over 5%, which means these rates should be available to you without ANY lockup period! In fact, I recently saw banks offering a higher rate for a 3 month CD than for a 6 month CD!

Alexander: Very interesting. So what can our viewers do about that?

Vienna: Well, for one thing how about opening a PayPal account that pays over 5% just for keeping funds in your account! Funds can be withdrawn directly from your bank account via EFT [or EFT/ACH, Electronic Funds Transfer] transfer and clear within just a few days. And you don’t have to lock your money up for 3 months or more to get that rate!

Alexander: That’s right. That’s basically because PayPal makes their money on transaction fees and use this as an incentive so that people don’t use credit cards. So while this is better for them (since they still charge businesses as if a credit card was used), it also works out in your favor as well.

Vienna: That’s exactly right Alexander! And for those worried about phishing attacks, PayPal’s new key dongle helps protect your account by changing your password every 30 seconds. The key will only cost you an extra $5 bucks!

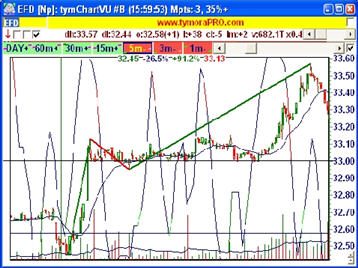

Alexander: And based on that logic, Vienna, another alternative to consider is placing funds in a brokerage account such as Interactive Brokers (NASD:IBKR, which is now also compatible with my trading platform tymoraPRO). While you may have to pay $10/month or so for real-time quote fees (hey, you’re actually GETTING something for your money), they pay you around 5% as well on your money, and you also have the ability to make a few trades. If you invest in a solid stock with a nice dividend, you’re tax rate will be down to 15% (note that not all dividends are taxed like this – such as for REITS – real estate investment trusts – so be sure to do your research).

Vienna: That’s right Alexander, and I also do that as well! When comparing banks with the best returns, watch out for the APR trick.

Alexander: The APR trick? What’s that? Please tell us more.

Vienna: Many companies will advertise what seem to be great rates, but the rates they show are actually the Annual Percentage Rate based on compound interest. If a company offers a 4.90% interest rate and another offers 5% APR, it’s actually about the same thing! Take away the APR “trick” and you’ll notice that PayPal is one of the highest paying around with a current 7-day annual average yield of 5.04%.

Alexander: And of course any of these rates are better than the .01 something offered by many of these free checking accounts. Finally, it’s important to mention that some of these accounts (such as PayPal’s) may not be guaranteed by the FDIC, so while the risks are still pretty small, there may be a small additional risk to consider.

Vienna: Yes, thanks for covering me on that Alexander!

Alexander: Hey no problem, and thank you so much for your keen insights today Vienna, I’m sure your fans are very appreciative that you took the time to share your insights with them, and we look forward to having you on the show again!

Vienna: Hey, no problem Alexander, it’s my pleasure helping all the little people whose loyalty helped me become the celeb I am today!

No Comments »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL