With a total float of $401M shares, at Friday’s closing price of $31.45 (after peaking just above $34/share near the open) IB’s market cap is valued at $12.6B, which gives it a greater market cap than both Ameritrade and eTrade!

So, let’s compare some of the fundies of companies in this space.

eTrade’s (NASD:ETFC) forward earnings are projected at nearly 12x earnings (factoring in 12% earnings growth) with over $10/share book value.

Ameritrade’s (NASD:AMTD) forward earnings are projected at over 14x earnings (factoring in 14% earnings growth) with over $3/share book value.

Charles Schwab’s (NASD:SCHW) – Chuck’s! – forward earnings are projected at nearly 18x earnings (with an estimated 13.5% earnings growth rate) with nearly $4/share book value.

Now let’s see how we can make IB’s numbers fit in. For 2006, IB’s diluted EPS were $1.21/share. What is truly impressive with IB is its 38% annual customer equity growth and 22% annual customer account growth. And these are no ordinary accounts either. On average, these accounts are by far much larger and more actively traded as compared to IB’s peers.

Last year IB’s earnings grew by a respectable 27% over its 2005 earnings. Let’s be very generous and say this year they can match their huge annual equity growth of 38% in a similar increase in earnings. That would bump forward earnings to $1.67/share. Now, giving IB the same multiple as Schwab would put IB’s “fair value” at $30, which is still below Friday’s close. If we consider the $7 in book value, we’re at a more respectable 14x earnings, though IB would still be trading at a hefty premium to its peers (which also have their own books values to consider).

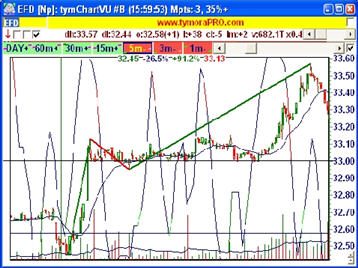

Again, traders and investors who open accounts at IB are much more lucrative than those from its peers. While IB’s average annual trades per account was 493 with an average commission per cleared trade of $4.25, Schwab had an average of 10 trades per account per year for an average commission of $13.38. So, on average an IB account generates 15 times more commish for the firm than an equivalent Schwab account! In fact, even tymoraPRO – the trading platform I created – works in conjunction with IB to form the ultimate trading, scanning, and analysis workstation for executing U.S. stock, options, futures, and forex transactions at reasonable rates and spreads. Oh yeah, and if you haven’t tried out tymoraPRO yet – especially as an IB user, you better get on the ball because you have no idea what you’re missing. It’s likely to expand your whole perspective on trading!

I believe the original IPO pricing much better reflects the potential value of the company, and given the opportunity I would perhaps consider investing in IB if prices returned to the low $20′s, especially as IB establishes itself over time as a new public company. I must say, however, that I’m impressed with the way Thomas Peterffy (IB’s chairman) handled the IPO. Demand was so high that there were over 145 Million shares bid at prices equal to or higher than the $30.01 offering price, with 27.5% of those bids receiving stock at that price. The auction’s clearing price was $33.00, which is the lowest price where the full 40M shares would have matched (which had already been raised from the 20M shares initially offered), and according to Thomas Peterffy, IB’s founder, the split of buyers was 80% institutional and 20% retail. However, the price was set to $30.01 in order to provide at least a temporary “floor” to the stock, especially with an extra 105M unfilled shares potentially interested in purchasing IB’s stock. [Quite temporary, as it turns out, as IBKR broke below $30/share after a few tries earlier Monday morning]

This is another example of IB’s shrewd management team at work, constantly balancing demand versus greed, and taking the other side where and when it makes the most sense. While there is no reason to overpay for the stock, IB may certainly be a good investment for those who have the patience to enter at the right time, once much of the initial hype currently priced into the stock has subsided. And when all is said and done, I still can’t overlook Goldman Sachs (NYSE:GS), which despite its already intense runup, is still trading at a mere 10.5 times forward earnings. And that doesn’t even consider its $82+ per share book value, nor the fact that U.S. monetary policy, along with the U.S. treasury, is essentially run and operated by a who’s who of Goldman Sachs alumni.

2 Comments »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL

You could definitely see your expertise in the work you write. The arena hopes for even more passionate writers such as you who are not afraid to say how they believe. All the time go after your heart.

Very good post. Hope to see even more great posts in the future.