As a trader, you’ll find that you’re usually your own worst enemy. It’s so easy to slip into bad habits that it’ll make your head spin. In this episode, we teach you what to watch out for, and how to focus in on finding the best low-risk high-reward trading opportunities. Stock mentions: NYSE:EFD

If you don’t see a great setup, don’t trade. This is a lesson that’s easy to forget if you don’t see what you’re looking for several days or more. And depending on your trading timeframe, the lesson may be forgotten within hours of not seeing what you’re looking for. So what’s the point of all this? Have you ever had a trade where all the factors line up correctly with a very clearly defined risk/reward scenario? I know I certainly have. And it makes me wonder why I sometimes get caught wasting time with weaker setups that clearly don’t offer nearly the same opportunity, especially when considering the risks of taking the trade. That of course goes back to dealing with ourselves and our feelings. However, if you focus on the types of opportunities you want to find, along with how good it feels to find and trade them, you’re positioning yourself to be aware the moment you see what you’re looking for. You also minimize the time you take away from that goal futzing around with the gunslinging trades.

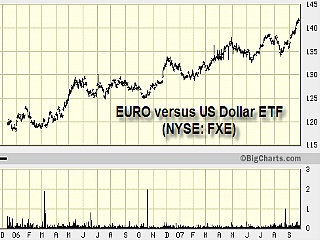

The other day I came across one such clear opportunity, and it makes such a great example of what to watch out for while trading that I just had to discuss it. EFunds Corp (NYSE:EFD), with a relatively low float of 47 Million shares and an 8% short interest, already a catalyst in place to take it higher. In addition, EFD popped up strongly on May 9th after it released its earnings, retraced 54% of the move, and has been steadily moving higher since with only minor pullbacks. On May 25th, 2007 EFunds Corp (NYSE:EFD) made a run to test all-time highs set just a few days earlier, before falling back to $33/share.

Now this is where it gets really interesting. Each time EFD attempting to trade below $33/share, a huge buyer would step in to buy any size that came into the stock. Whatever size would appear on the bid at $33/share, if someone stepped in to sell 15T shares, it was immediately absorbed in a single print and be refreshed with new size. Several blocks of 10T or 15T shares in a row? Gone. When the selling would settle down, EFD would easily drift higher. However, as no large buyer was yet willing to step up much above $33/share, EFD continued to channel from $33 to $33.15 for the next 5 hours or so. During that time, EFD did manage to fall below $33 once at 11:12am, and it immediately jumped back above $33/share so quickly it would have made your head spin. Obviously, someone wanted as much of the stock as possible at $33/share, and it wasn’t all that difficult to figure out exactly why. And, with deep pockets such as these behind the buying, I could only imagine how the trade would unfold once the shackles were unleashed and the buying became aggressive while short-sellers simultaneously ran for the hills. And that’s exactly what happened in a move that began at 2:15pm, taking EFD steadily higher until it topped out at $33.57 at 3:30pm before pulling back. This second wave was nearly identical in length to the original thrust move off the day’s open.

As a trader, finding just one solid trading opportunity a day is really all you need to focus on. The more clearly you can define the factors in your favor while taking as small a risk of possible, the greater your chance of success. It will also give you the additional confidence you need to put more capital at work behind the best opportunities you find, thus maximizing your potential returns. These are not only the types of trades I focus on finding with tymoraPRO, the trading platform I created, but also some of the types of trades that I discuss in my “Trading to Win” book, as well as my “Be Your Own Hedge Fund” DVD.

How NYSE:EFD has performed since that day… It unfolded again into a second larger dual-thrust pattern.

No Comments »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL