If you spent a million dollars a day since the birth of Christ, it still wouldn’t even amount to ONE trillion dollars. However, a series of bailouts, bank rescues and other economic lifelines could end up costing the federal government as much as $23 trillion, the U.S. government’s watchdog over the effort says – a staggering amount that is nearly double the nation’s entire economic output for a year, with our most recent GDP figures coming in just over $14 trillion.

That’s more than the total amount spent by the U.S. on all the wars it has ever spent, even accounting for inflation. By comparison, going to the moon in 1969 cost an estimated $237 billion in current dollars, and the entire Depression-era Roosevelt relief program came in at $500 billion (according to Jim Bianco of Bianco Research).

These figures are considered worst-case scenarios, and that’s where we find the most humorous part of this story. According to Treasury spokesman Andrew Williams, “The $23.7 trillion estimate generally includes programs at the hypothetical maximum size envisioned when they were established. It was never likely that all these programs would be ‘maxed out’ at the same time.”

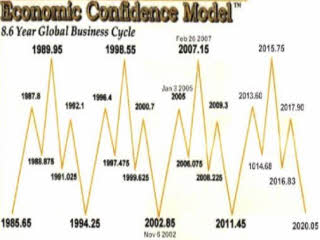

That’s interesting… I mean, what are the odds that something like this could ever happen?! Somehow the universe likes to test us on the one in a billion odds that everything will likely happen at the same time, especially where money is concerned. Perhaps that’s because when you combine monetary weapons of mass destruction such as huge leverage, unlimited reckless spending, wild levels of borrowing, and a non-stop printing press, history has proven over and over again that there is always a day of reckoning, usually triggered by a single event that causes all the other dominoes to collapse one after the other in a giant waterfall-type debacle.

But once it’s here, watch for all the news stories blaming speculators, or republicans, or democrats, or the rich, or the Chinese, or whoever else would make a good target for finger-pointing away from those who are always responsible. The real culprits usually include most politicians (democrats and republicans), along with the secret group of people you’ll never hear about who control them through bribes lobbying, favors, or simply because they are too powerful, wealthy, and politically well-connected to risk alienating.

If the democrats screw things up, the republicans will come in and continue the same ‘ole game. When they screw up, it goes right back to the same few democrats that are once again presented to the public for “consideration”. And thus the circle of destruction continues, with no one having any accountability beyond their ability to slip past the next election.

Don’t worry, though, the odds that all their shenanigans backfiring on us all at the same time is virtually nil. Just like when Ben Bernanke flat out told us that he had no doubt the subprime crisis would be easily contained, with little spillover or no to other areas of the economy. Uh oh, I suppose “virtual nil” still means there is a chance…

RSS feed for comments on this post.

RSS feed for comments on this post.

This is a crzy amount of money but when you look to the banks receiving huge portions of this money they are NOT being reformed. Bank of America recently recruited their new CEO internally (So major changes happening at the B of A then.) and I have not heard of a bank that is straying away from the bonus related culture that played a big part in insitgating this crisis!

So….if I bribe someone I can get 23 trillion dollars?!