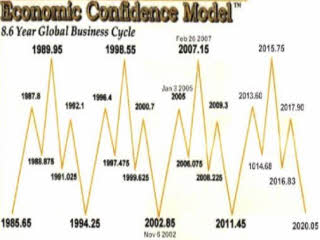

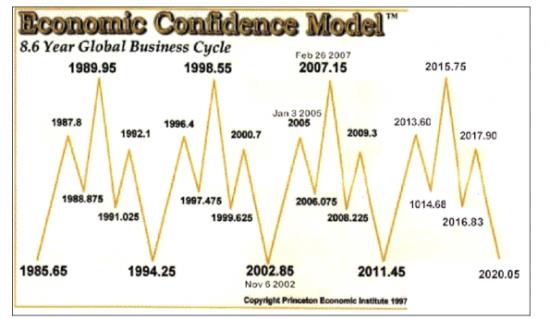

Martin Armstrong is the author of the Economic Confidence Model based on an 8.6 year business cycle theory inspired by the work of Nikolai Kondratieff. Two years ago, the cycle once again accurately predicted the peak of the last economic cycle years in advance. February 26, 2007 yielded some of the tightest credit spreads ever (easy access to credit), and the housing market had already begun its sharp decline.

He is currently in prison, indicted in 1999 on charges of defrauding Japanese investors. His trial would have made more sense had it taken place in “Alice in Wonderland”. Without getting into all the details here, just the fact that he was in jail for seven years for contempt of court should be enough to make any American cringe and wonder how that’s possible in the great ‘ole USA. He finally caved in and plead guilty in 2007 to the fraud charge. In return, he was given an additional five year prison term in addition to the seven he had already served! Now, if this were any ordinary American schmo, perhaps he could be written off for one reason or another as just another guy with a crazy “they’re out to get me” sob story. However, when you look deeper into the facts, and then consider that Mr. Armstrong was also one of the most respected financial research advisers to scores of powerful figures from central bank executives to heads of multinational corporations to heads of state, it really makes you wonder what’s going on with the “Rule of Law” — the real glue that holds our country together. Armstrong even authored the most insightful and thorough analysis of the 1929 crash ever assembled on behalf of the Reagan administration in the ’80s.

From his jail cell, Martin Armstrong continues to write some of the most insightful and interesting essays I’ve come across on a variety of topics from market cycles, to rule of law, to the history and cycles of politics and war. Since he has access to little more than an old typewriter (and no whiteout), you must understandably have a bit of patience with his “what I’m thinking about now” writing style. Would I be showing my age if I can still recall the nightmare of using a typewriter for school papers? It’s horrible.

Regardless, I’ve learned more useful knowledge about world history (and our own history) from Armstrong’s essays than I ever learned in school. And it’s more fascinating than you can even imagine. Everything’s been done and tried before. And here’s some food for thought… in the six thousand or so years of civilized history, can anyone find one example where socialism actually succeeded with a happy ending? But I guess that’s why most politicians don’t bother to learn any of history’s lessons. It would just interfere with their agendas and other questionable motives.

The following text is an excerpt from Martin Armstrong’s latest essay entitled “Objective vs Subjective Analysis” (pages 10-12). I’ve also taken the liberty of making some small corrections here and there to make the text more readable while still hopefully maintaining Mr. Armstrong’s full meaning and intent.

“Objective vs Subjective Analysis” (pages 10-12) – Martin Armstrong

Subjective Thinking has doomed just about every field in which it has been used. If we cannot look at something Objectively, we cannot see the truth. We must divorce passion and bias from reasoning. We are caught within a cycle of endless chaos, for we are constantly trying to reorganize the economy based upon Subjective Reasoning. We cannot tell the economy this is what we think, and thus this is the new law. If there is no Objective Reasoning on how things work, we are constantly going to repeat the same folly time and again.

Subjective Analysis Fails

A friend once said to me why the major institutions around the world were relying on Princeton Economics. He said quite bluntly over lunch in Geneva, “Opinions are just like assholes. Everyone has one! We need facts only!”

I have received a lot of questions with respect to the New York Article and the many different forms of trying to diviniate the future. I am not a supporter of Elliott Wave or other forms of subjective analysis because of the lack of raw hard facts.

At Princeton Economics, we always kept an open mind and tried to explore anything that may work. The computer would do pattern recognition. At first, I assumed it would be reasonable that you should be able to take the last 10 days of trading and have the computer search the entire database of that market to find a match to see if the 11th day did the same thing as in the past.

The computer would precisely map out the last 10 days with a percentage relationship of the open, high, low, and close for each day, and in relative position to the previous day. To my shock, even going back 100 years of daily movement, the computer could not find 10 days that ever did the same thing on a precise basis. I then tried shortening the time span, reducing it from 10 days to 3 days. Finally, when I reached the 3 days of a pattern it would find a couple of matches. But there was still no definitive correlation to the next day.

I then instructed the computer to explore just the overall pattern of the 10 day period. In this way, we would take say 10 days and map out the high was on the 8th day, and the low was on the 3rd day. We also made sure each day was the same as far as being an up or down day. Here we had much more success. But the results to predict that illusive next day were at best 50/50.

We eventually developed some highly and very interesting accurate views under patterns. But this took a lot of computer power to do, and some mind bending ways to carving up the patterns to be tested. What this exposed was something very much embedded in everything. To sum it up, “is the glass half full or half empty?”

The human mind processes visual input in a unique manner from audio. Instead of listening to songs and determining if they spark some distant memory, visual input can do that, but it can also see patterns of faces or other things within clouds.

We can visually map out patterns without having the completed picture. It is true that we can listen to a brief portion and perhaps relate that to a known song, but when dealing with patterns, we can see faces that are not even known.

Therefore, when we come to pattern forms of analysis such as Elliott Wave or Technical Analysis, we are stepping into a world that is highly subjective. Two people using the very same methods can arrive at different conclusions.

This is why the technical analysis I had developed was objectively based using purely the opposite events either side of a high or low. I removed the subjective side of just drawing lines because they looked nice or had agreed with a predetermined expectation. This is why I believe that these forms of analysis can provide great targets for price, but they cannot tell you when or even if that expected trend will emerge. To accomplish this, we must divorce passion from reason, for the greatest danger of Subjective Analysis has always been making the analysis fit preconceived ideas.

One of the most interesting differences between the typical Subjective Analysis and Objective Analysis is who’s calling the shots. Keeping in mind when one person looks at a cloud and sees a face, another may fail to see the pattern altogether. Our mind will fill in the blanks when using our visual processes, so we must be aware of that potential.

Projecting the future on purely pattern recognition is very speculative at best. The critical factor will be the experience of the observer. One who has traded for many years will see in the patterns memories of trends long since past. Thus, someone who has been burned by a crash, if he does not embrace his loss and try to now reason why it took place, will end up being skeptical of every rally and only look for the opportunity to sell.

Others will pitch that nobody can predict anything so the key is to (1) hold long-term, and (2) average in on the dips. The problem here, when the big-one comes, you are totally wiped out with nothing left. This is the sales pitch taught brokers to drum-up business — not to actually help clients make money.

The real trick is to let the market tell you what to do, and never try to tell the market what to do or what should be done! There is an old saying — you can’t fight the tape. That means the market is always right. If it is not performing the way you expect, you are dead wrong, never the market.

The Dow Jones Industrials is the perfect example. While it would have been nice to just get the Waterfall Effect into a June 2009 low at 4,000 and then swing like a pendulum out and to a new high for 2012, the market stopped precisely with the 17.2 month frequency from the 2007 high. This warns us that the March 2009 low may in fact hold, and while we should retest support, the low may be in place. However, I also warned that if we were to be on course for a dramatic rise into 2016, then the key will also require the Dow to start in part to move contrary to the dollar, which it has begun.

The critical resistance still remains at the 11,000 level on a monthly closing basis. The primary resistance for the year-end closing will stand at 10,800 and then 12,500 with the major support at 6,600 and 6,200. There should be forming a pivot point for next year at the key level of 8,800. If the Dow remains above this area, it will be short-term still positive. Falling below this level will suggest we are turning for a retest of the support.

From a timing perspective, the key monthly targets are December 2009 and May 2010. We could still see new lows in May without a monthly closing above 11,000. But if December at least closes above 10,800, then a retest of support into May 2010 should hold the 2009 low. The now critical long-term support has moved up from 4,000 to the 5,000 level for 2010.

Being able to see into the future is a lot different than reading tea leaves or trying to figure out how the pattern will now play out over time. The market actually will tell you what is to come once you are willing to open your eyes to pay attention.

At Princeton Economics we devised the various different ways to carve up the key movement of the global economy and the core markets around the world. What was critical to comprehend was TIME, and once you began to see that markets were fractal in nature, the movements were the same on all TIME levels.

Major trends such as the 2007.15 (02/26/07) high on this cycle, are easily seen for they will unfold on all levels and thus proceed on a slow motion basis. In the same way, it can be stated with absolute certainty that the global debt crisis in Western nations will resolve itself as always, and without exception, in complete chaotic default. No government has ever paid off its debt. Adam Smith pointed that out in his chapter on government debt back in 1776. Sadly to say, that statement has proven to be correct ever since.

Once a country begins to borrow, it is like a drug addict. It will never stop and at some point the interest will consume all productivity. No system can be supported on this basis. The government will first wage war against its own people as we are doing right now going after Switzerland. As they imprison and destroy capital, they will then reduce the economic growth. They will chase capital from the nation and cause it to be hoarded. That will reduce the velocity of money and thus further reduce the economic growth. Therefore, government will only see its own self-interest, and that will prevent it from learning or listening to any alternative. That completes the cycle of collapse.

Just as I pointed out about slavery, it may at first sound nice that you can just buy cheap labor, but that has the adverse effect of lowering land values and makes the small farmer incapable of competing. It becomes self-destructive and eventually as the slave population increases, the cost per slave now rises. This became a major debate in Rome, for its economic consequences created major problems.

Government debt functions the same way for the larger it grows, the greater the cost will rise to support pre-existing debt as it now consumes all the productive capacity. By means of this cycle of debt, EVERY NATION TO DATE has simply collapsed. We shall be no different.

Every society engages in Subjective Analysis to disagree with that statement. Somehow we are different – more advanced in both our arrogance and stupidity. So as the wishful thinkers try to blow smoke to cover what they do not want to look at, the clock keeps ticking away.

The long-term trend is unquestionable. We will collapse – there is really no possible dispute about it. This is as certain as the sun will rise and the earth will rotate. It would be nice if Government would listen and we could do a slow burn to save the future. But that is just not going to happen with lawyers and academics at the wheel.

The markets will tell us what they are doing if you are willing to listen. In the DOW Jones Industrials, the 10,800 level is critical for year end. If the Dow closes above this level, it is warning that the wave of inflation that is on the horizon is in fact coming faster than anyone expects. A year-end closing below 10,800 will not be a sell signal, just a neutral indicator on the immediate time line for 2010.

Resistance will still stand at 11,800 for 2010 and the 11,000 and 10,000 numbers will present pivot points as well. We will see below 8,800 and 8,300 as initial key support with major support starting at the 6,200 level.

Closing support for the DOW will be at the 8,600 and 7,200 levels. A closing below the first will signal a retest of lows for May where as a year-end closing below 7,200 will signal a test of the 5,000 level with the most extreme support at 3,800.

Keep in mind however, this is a pendulum type movement. The further it goes toward support, the greater the energy will be to swing to higher levels in the future. There is no question that the two yearly targets for major crisis are 2011/12 and 2016. The market will tell us very soon how nuts this whole thing is going to get. Those who harp on the same old thing unfolding as 1929, only look at charts and know nothing about how the global economy interacts, since back then we were the creditor nation.

RSS feed for comments on this post.

RSS feed for comments on this post.

The company brokerages network will provide you with access to a large pool of people who’ve the details about companies for sale and buyers or investors looking for any organization venture. By producing great use in the information you have, you may be cutting a offer and make a handsome profit out of the transactions.

Market research, finance understanding is it very difficult for some people, so many good things that investors try to improve on such speculation and this is in improving its expectation to see which are the reactions market.

Emergency! Martin Armstrong Needs Your Help Now!

Martin Armstrong is being illegally moved to a hell hole jail in as an obvious payback for speaking out

Moving Marty is a clear act of retribution in direct violation of the law. As a result of the “The New Yorker” magazine article and the subsequent fact that many additional members of the Press have been trying to gain access to him, the new Fort Dix Warden Donna Zikefoose and her henchman David Steel and K Byrd, have ignored federal law and are attempting to move Marty to one of the worst, dirtiest, most unsafe jails in the US where he will not even have access to the sun let alone a type writer for the remainder of his sentence. This place is truly one of the worst jails in the United States. Marty will be mixed in with accused murderers, and other violent and dangerous types. They are attempting to slip this through over the holiday hoping to avoid notice. The facility they want to send him to is BOP (Bureau of Prisons) MDC (Metropolitan Detention Center) Brooklyn New York where they will work him for 11 cents an hour as a cadre. This is the sister facility to the one in Manhattan where Marty spent seven years in contempt (never even seeing the sun) and was almost beaten to death and wound up in intensive. This is a quote from Last paragraph of Marty’s Paper of “Looking Behind the Curtain…The Real Conspiracy” April 9, 2009 Paper. Marty tells the harrowing story as follows… click links for full story please tell everyone

http://www.scribd.com/doc/23295251/Emergency-Martin-Armstrong-Needs-Our-Help

http://economicedge.blogspot.com/2009/11/martin-armstong-forced-to-move-to-high.html

[...] And here’s some food for thought… in the six thousand or so years of civilized history, can anyone find one example where socialism actually succeeded with a happy ending ? But I guess that’s why most politicians don’t bother to learn …Continue Reading [...]