(Mish) “We will not get to see the precise wording of Prime Minister George Papandreou’s referendum because enough cowards in the Greek parliament in conjunction with blackmail by Merkel and Sarkozy have put an end to Papandreou’s regime. Thus, the on-off on-off Greek referendum is once again set to ‘off’ this time permanently.”

(NYTimes) “Europe’s leaders should have paid more attention to the distress of ordinary Greeks and less to the distress of well-heeled European bankers. Rather than trying to punish the ‘profligate,’ they should have thought about the consequences of condemning Greece to years of negative growth, soaring unemployment and rising taxes with nothing promised in return except that maybe, a decade from now, its ratio of debt to gross domestic product might get back down to the problematic levels of 2008-9.

Greece needs to make serious, painful reforms, including doing away with antiquated labor rules, streamlining a bloated public sector and selling off poorly managed state assets. Mr. Papandreou was already making real progress. But it was becoming impossible to keep laying off thousands of state workers while austerity choked off any realistic possibility of their finding private sector jobs or to keep slashing social benefits and services while the numbers of poor and unemployed surged.

It is late but, we hope, not too late to avert a full meltdown. Europe’s leaders need to renegotiate the pending Greek bailout deal to emphasize reform and growth over unremitting austerity and offer other bailout applicants the same approach. If they want any of the money lent to Greece paid back, Athens needs room to grow and earn.” — Greece on the Brink (NYTimes)

(Mish) “Democracy Dies to Protect Banks – Indeed, resolution of this mess has been 100% about how to bail out banks at taxpayer expense even though banks brought this mess onto themselves by treating sovereign debt as if it had zero risk. Worse yet, banks plowed into sovereign debt trades with massive leverage.”

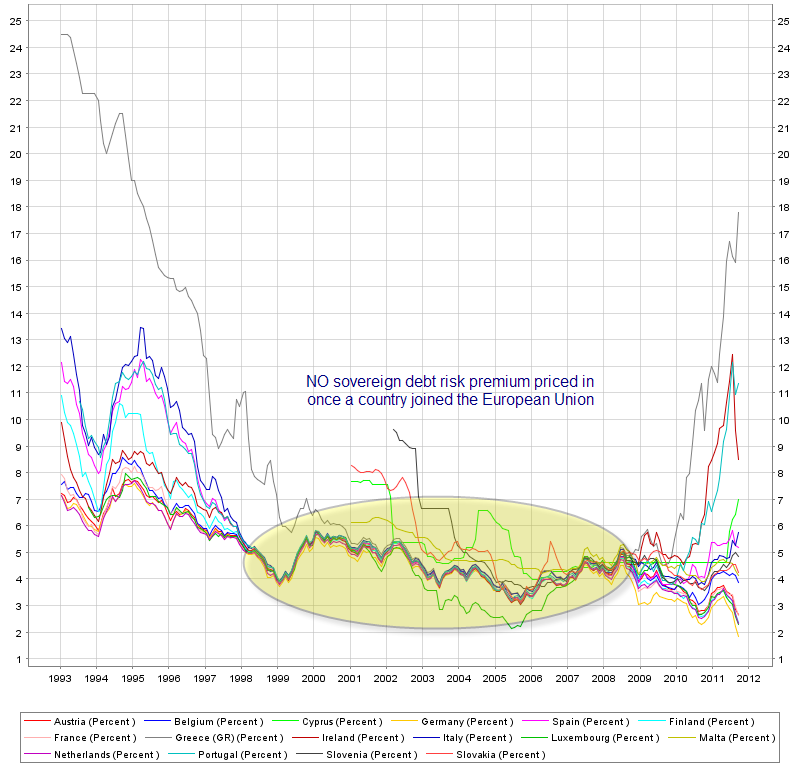

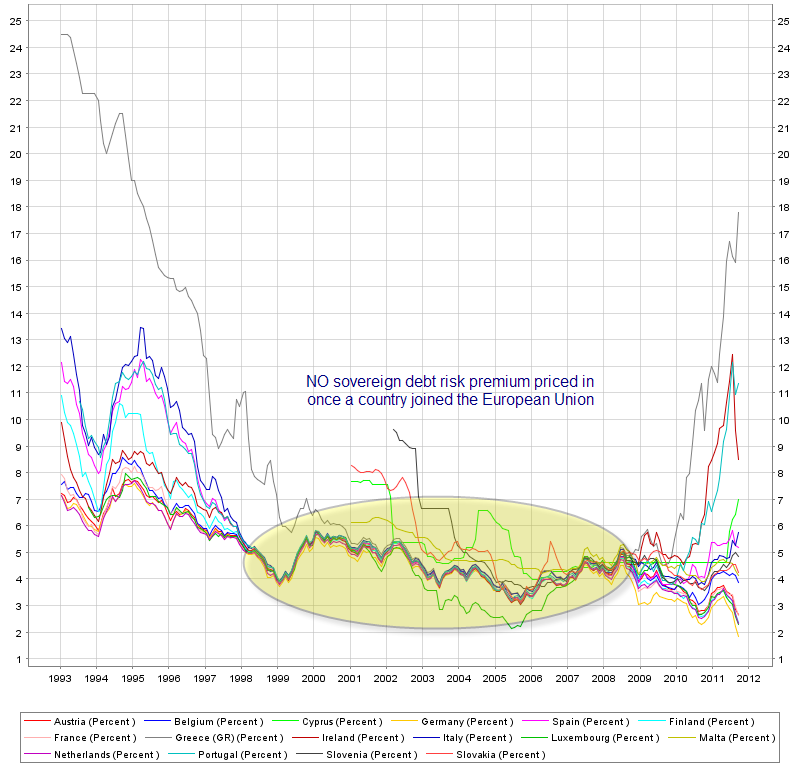

Notice the tight convergence of all Eurozone country sovereign debt interest rates before 2009. European banks and other investors placed foolish bets anticipating little or no additional risk. They priced in virtually no risk premium holding Greek bonds over German bonds.

(Mish) “Merkozy and the EMU ought to be spending time on developing a full blown Euro exit strategy for nations because there has never been a currency union in history that has survived without a fiscal union in place at the same time.”

(MartinArmstrong) “The most important aspect is the economy. Screw that up and you get war, depression, and starvation. We then elect a whole bunch of people to posts and automatically assume these people have the (1) real intelligence ABOVE average to comprehend such complex subjects, and (2) they understand the right thing to do. Where did we ever get these ideas? Most of the staff members employed by politicians are smarter than the people they work for. But unless they believe an economic crisis is possible, they will not even look at the issue.” — Martin Armstrong, Happy Days Are Here Again

RSS feed for comments on this post.

RSS feed for comments on this post.