(GlobeInvestor) “ETNs expose investors to the risk of losing all or most of their principal. That’s because ETNs are set up as unsecured, long-term debt obligations of the issuer, Ms. Pelant explains. ETF investors don’t face the same default risk because ETFs own a pro rata stake in a basket of stocks, bonds, or derivatives held by a custodian in trust and legally separate from the issuer, she says.”

“When Morgan Stanley’s viability came under question in September [2008], its family of Market Vectors ETNs sold off dramatically. ‘The Market Vectors Remnimbi/USD ETN (CNY) plunged more than 25 per cent versus a 1-per-cent drop in a comparable ETF,’ observes Greg Newton, a veteran financial journalist who writes the NakedShorts blog.”

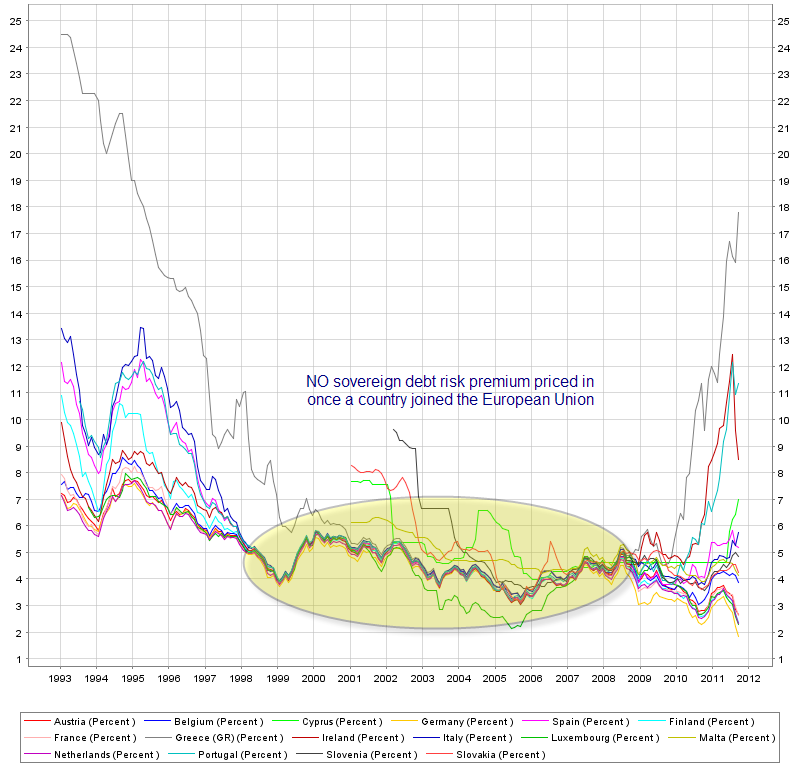

However, if the ETFs don’t actually hold the securities that make up the fund, and instead use synthetics or swaps rather than physicals, investors may also be exposed to much more credit and counter-party risk than they realize. And as Jeffrey Gundlach discussed at the recent DoubleLine Luncheon at the New York Yacht Club, “Never, ever take counterparty risk. It is the one risk you are almost never rewarded for taking. Unless you are running $800 billion dollars, there is no need to use swaps, synthetics or baskets – trade cash markets and avoid any trades that require a counterparty.”

(HistorySquared) “In light of the counter party risks inherent in ETFs, especially those that use synthetic swaps rather than the physicals, there might be an inexpensive way to express a bearish view on some of the European banks.

For example, in 2008 Lehman Brothers had several failed ETNs. ‘The three ETNs were Opta Lehman Commodity, Agriculture and Private Equity. In September 2008, these ETNs halted trading when Lehman Brothers failed. Currently, the final results are [still] being sorted out, but it appears that Lehman ETN holders will receive 2 cents on the dollar from their original investment.’ ”

These are some clever lower-risk trading ideas for expressing a bearish view on the future solvency of a particular counterparty:

“Perhaps there are some far OTM [Out-of-the-Money] options on some of the Socgen ETFs that are worth a look [especially if volatility premiums don't appear to factor in the risk of a credit default]. Or a less risky trade could be long an ETF with physicals underlying the ETF that is issued by a more secure bank, and short the highly correlated Socgen ETFs. A potentially catastrophic event could be triggered by Deutsche Banks popular x-trackers.”

Full Story: ETFs as Tail Risk Trades (HistorySquared)

(Bloomberg) “ETFs that use swaps to clone stock, bond or currency returns have been criticized by regulators and firms including Fidelity Investors, which say clients risk losing money should the banks writing the derivatives become insolvent. Outflows from Lyxor are another blow to Societe Generale, France’s second-largest bank, whose shares have tumbled this year as the escalating sovereign-debt crisis squeezes lenders’ funding.

‘It’s an issue of counterparty risk related to the financial health of the backing bank,’ said Jose Garcia Zarate, an ETF analyst at Morningstar Inc. in London. ‘Fears over synthetic replication have been building up, and at the same time, fears of banks’ peripheral-debt exposure have grown. Put those two together: bingo!’ ” — Swap ETFs, Lyxor Have Record Outflows (Bloomberg)

RSS feed for comments on this post.

RSS feed for comments on this post.