Traders seeking an edge are always keeping an eye out for interesting insider trading activity in a particular stock. Taking this a step further, there are certain characteristics that can be identified to really “kick” things up a notch. In this second episode, we’ll be discussing a few more setups to watch out for, as well provide a few more examples. Stocks mentioned: NASD:TRGL, NYSE:LUK

Another good time to watch for insider trades to occur is near all-time lows, or at least 12-month lows if that’s what comes up. This can be really powerful if it occurs after a huge panic drop in price, especially in a stock that already had a high level of short interest building up. The combination of the final panic-sell off (increasing short interest even further), along with sizeable insider purchases at those levels, is a perfect setup to potentially drive prices much higher. Toreador Resources (NASD:TRGL – an oil exploration company) is a great example of this, having recently panic traded down to about $12.50 from a high of over $29/share. Several days after TRGL hit its low on HUGE volume (almost 5x normal), director William Lee bought 100,000 shares at $13.63/share. Before the move, TRGL was already showing a 14%+ short interest. Even better, the stock’s float is a mere 13 million shares! Interestingly enough, the purchase caused little immediate reaction. However, several days later TRGL exploded higher, hitting $17.40 before pulling back!

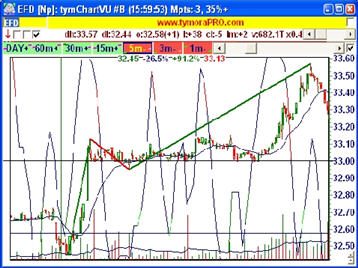

Our final example in this two part series is Leucadia National (NYSE:LUK), which has been described as a “mini Berkshire Hathaway” but with an even better track record (its average annual return – so far – is currently over 22%). So when LUK’s Chairman Ian Cumming bought another 100,000 shares at $34.57 on May 23rd, near all-time highs, it certainly made a strong statement about his future outlook for the company. Tack on the nearly 5% short interest in the stock that could take over 5 days to completely cover based on LUK’s average daily volume, and at least a few shorts are bound to be rather disappointed as they find themselves caught with their pants down.

For viewers interested in learning even more strategies you can use to maximize your chances at trading success, be sure to check out my “Trading Secrets to Win” book, as well as my “Be Your Own Hedge Fund” DVD.

And again, you can also begin scanning for your own potential insider trades using the free insider trading tools feeds we offer at “www.yourika.com/feeds“!

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL

Please Log in and Leave a Reply!

You must be logged in to post a comment.

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL