This abridged version contains only my synopsis, and does not include Alan Greenspan’s article on “Gold and Economic Freedom”. It does, however add an extra bit about 2007′s top performing Stock Market in Zimbabwe! It’s up over 12,000% in 12 months! Of course, the country’s consumer price index was rising (i.e., the purchasing power of currency declining), was also rising at a rate of 1,729% a year. So how much are all those Zimbabwees worth anyway, even in dollars?

Gold and Economic Freedom — by Alan Greenspan – [written in 1966]

(This article originally appeared in a newsletter: The Objectivist published in 1966 and was reprinted in Ayn Rand’s Capitalism: The Unknown Ideal)

For those of you wondering, those were Greenspan’s beliefs BEFORE he became head of The Federal Reserve. Really makes you wonder what happened. It’s as if he went out to prove a point that if you spike the punch bowl at the party, the pleebs will happily sop it all up, get totally wasted, then go back for another round without a second thought, despite the fact that they’ll all be puking it out their guts the morning after.

But lately, Greenspan has been making negative remarks on the state of the markets…

Of course we’re where we are today because of Greenspan, or more specifically, because of the Fed.

But it’s still rather comical that CNBC (and others) choose to now find ways to discredit the “maestro” Greenspan, their “HERO” so long as his perspectives (or as Fed Chairman, his actions) suit their needs. He used to be a dancer, they say. He’s been full of gloom and doom as of late. Why now? What worst timing with everyone so focused on Bernanke’s next move? He’s a bad bad self-promoting marketing lad. The markets will eventually do what they’re meant to do regardless of what Greenspan says now. Back in 2000, attacking everyone and anyone who said the .COM Bubble was about to painfully burst, or the real-estate bubble for that matter, certainly didn’t stop it from happening. But at least it’s nice to know that attacking the naysayers makes some people, or at least some of the reporters on CNBC “feel better” (eh hem, Mr. Haines). Of course, policies can be made to propogate our “feel good” Pleasantville-like society, but as we’ve again recently witnessed, it’ll feel much worse once we all wake up from the delusion that this is not just a subprime problem, but a full-fledged credit and inflation-based bubble. Yet it is interesting to know of Greenspan’s early career perspectives. How come he doesn’t discuss in his book how these perspectives changed from before he became Fed Chairman – oiling the giant machine. Perhaps Greenspan loved being the “life of the party” at the biggest show in town. And he certainly never wanted to be blamed again after Bush Senior lost his re-election.

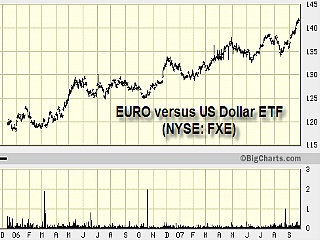

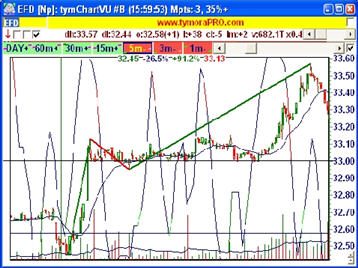

In the meantime, I guess I’ll just keep watching my stocks and other assets appreciate in value in their attempt to simply keep up with inflation (especially after taxes are paid on fake inflation-based profits), to the detriment of the pitiful debased value of the dollars I dare not try and save in my pocket. I’ll be especially worried, however, once Bush Junior leaves office because historically the party ends shortly after a new president takes office.

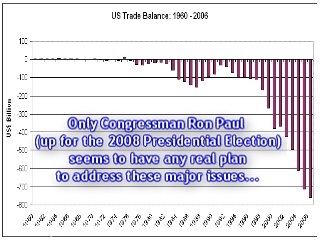

Oh, and a point to Donald Trump – while a novel idea, good luck in getting someone to go “over there” (to the Middle East that is) with leadership and telling them to “stop with the crazy oil prices”. I’m sure you would have been laughing in the face of anyone telling you “enough with the insane inflated real-estate prices you’ve been able to get for the apartments you sell” – how would you feel about a real-estate price-cap per square foot, or even cooler, how about a price floor!? I offer you the same answer that I am quite certain you yourself would offer, “if you don’t like it, don’t buy it!” If you want lower oil prices, tell the Fed to stop adding boatloads of computerized credit liquidity into the money supply for reckless companies and hedge funds to over-leverage to the edge of oblivion, and allow interest rates to float freely as a true tribute to an “open and free market economy”. And Perhaps you can also have Larry Kudlow explain how the Fed’s monopolistic maneuverings – even admitted to by his “hero” Alan Greenspan – fits in with his creed, that “Free market capitalism is still the best path to prosperity”.

Finally, for anyone who really wants to understand what’s going on with the Fed, and how futile it really is for a small group of elite people to dictate how the world “should be”, watch Jon Stewart’s interview with Alan Greenspan on The Daily Show. It’s gotta be the best (and most honest) Greenspan interview I’ve ever watched. He says he’s been in the forecasting business for over 50 years and he’s still no better than he ever was because human nature hasn’t changed – because we can’t improve ourselves. Actually, I would think that would make it easier for him to make predictions – cheap and easy credit equals people going bonkers, but truth be told one thing you could always count on was that Greenspan’s predictions were always completely wrong. And his latest prediction that the “credit crisis may be close to ending”? Well, I guess only time will tell for certain…

1 Comment »

RSS feed for comments on this post. TrackBack URL

RSS feed for comments on this post. TrackBack URL

I am Zimbabwean living in England and I used to live in Harare, I must say that my country has been ruined by world’s biggest terrorist which is Mugabe, look at the exchange rate, poverty, economic conditions of Zimbabwe. When I think about it my heart really goes, I wonder why Mugabe does not let citizens of Zimbabwe decide the future of the country and also Mugabe must realize that he is in power since last 30 years his mind is getting old and he cannot think the same as young generation can think, so he must resign for the better of Zimbabweans. Thank you